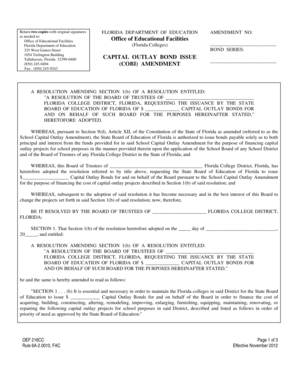

NY B-1231 - Erie County 1995-2025 free printable template

Show details

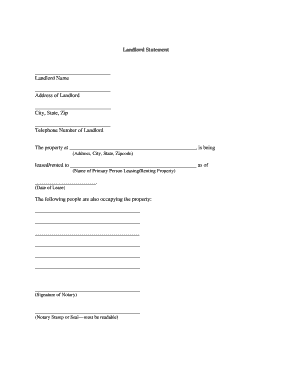

E. TO LL TEAM YES NO PER ERIE COUNTY TAX RECORDS CASE NAME CURRENT ADDRESS CAT/CASE NO. LANDLORD STATEMENT LANDLORD PLEASE COMPLETE ENTIRE FORM IN INK AND SIGN BELOW TENANT S NAME ADDRESS RENTED No. AMOUNT OF RENT CHARGED Street Apt. ERIE COUNTY DEPARTMENT OF SOCIAL SERVICES Division of Financial Assistance 158 Pearl Street Buffalo New York 14202 DATE SENT DATE STATEMENT RECEIVED OFFICE USE ONLY RETURN BY EXAMINER INFORMATION VERIFIED PERT. No* Per Month Week Twice Monthly City State...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign landlord statement form

Edit your erie county landlord statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your b1231 landlord statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit landlord statement erie online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit social services landlord statement county form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out landlord statement form

How to fill out NY B-1231 - Erie County

01

Download the NY B-1231 form from the Erie County website.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal information, including your name, address, and contact details in the designated fields.

04

Indicate the purpose of the application or request in the appropriate section.

05

Fill out any required financial information, if applicable, ensuring accuracy and completeness.

06

Review all entries to ensure there are no mistakes or omissions.

07

Sign and date the form at the bottom, confirming the information provided is accurate.

08

Submit the completed form following the provided submission guidelines (mail, online, or in person).

Who needs NY B-1231 - Erie County?

01

Individuals or businesses requiring permits or licenses in Erie County.

02

Residents seeking to report specific information to local authorities.

03

Persons needing to apply for benefits or services that require this form.

04

Anyone involved in legal or administrative proceedings that necessitate the completion of NY B-1231.

Fill

new york landlord statement

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file landlord statement erie county?

In Erie County, New York, all landlords who receive rental income from tenants are required to file a landlord statement with the county. The statement must be filed annually, by April 1st, with the Erie County Comptroller's Office.

What is the purpose of landlord statement erie county?

The purpose of the Erie County Landlord Statement is to provide landlords with information about tenant rights and responsibilities in the county, as well as landlord rights and responsibilities. It also outlines the legal obligations of the landlord and tenant, and serves as a resource for landlords to use when entering into a rental agreement.

What is landlord statement erie county?

A landlord statement in Erie County is a document that provides information about a tenant's rental history, including details about their tenancy, rent payment history, and any outstanding balances or disputes. It is typically requested by other landlords or property management companies when considering a potential tenant's application for a new rental property. The statement is filled out by the previous landlord or property manager and serves as a reference for landlords to assess the reliability and trustworthiness of a tenant.

How to fill out landlord statement erie county?

To fill out a landlord statement in Erie County, you can follow these steps:

1. Obtain the landlord statement form: The Erie County Clerk's Office or the Erie County Department of Real Property Taxation should provide this form. You may download it from their official website or visit their office in person.

2. Review the form: Thoroughly read through the entire form to understand the information required and the format in which it should be provided. This will help ensure you don't miss any important details.

3. Gather relevant information: Collect all the necessary records and information required for the form, such as the property address, tenant's name(s), rental lease terms, and rental payment details.

4. Start filling out the form: Begin by inputting the property details at the top of the form, including your name as the landlord, your address, and contact information. Then, provide the names and addresses of all tenants residing in the property.

5. Tenant information: For each tenant, include their full name, address, and the dates they occupied the property. It may also ask for additional details such as the rental amount and payment frequency.

6. Sign and date the form: Once you have completed filling out all the required information, sign and date the landlord statement form. Make sure to include your current date of signing.

7. Submit the form: After finishing the form, make copies for your records and submit the original to the appropriate office. Check if there are any specific submission instructions or attachments required, and ensure you comply with those requirements.

Keep in mind that this guide is general and may not cover all the specifics of the landlord statement form used in Erie County, New York. It is advisable to consult the official Erie County Clerk's Office or the Erie County Department of Real Property Taxation for detailed instructions or any specific requirements they may have.

What information must be reported on landlord statement erie county?

The information that must be reported on a landlord statement in Erie County may vary depending on specific regulations or requirements, but generally, it may include:

1. Landlord's name and contact information

2. Tenant's name and contact information

3. Property address

4. Lease start and end dates

5. Rent amount and payment frequency

6. Itemized list of charges or fees (e.g., security deposit, pet fee, late fees)

7. Maintenance or repair expenses incurred by the landlord

8. Notice of any rent increases

9. Record of rent payments received

10. Any outstanding balances or unpaid rent

11. Notice of past or pending legal action

12. Signature and date of the statement

It's always important to refer to local laws and regulations specific to Erie County or consult legal professionals to ensure compliance with the reporting requirements.

How can I manage my social services landlord statement directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign b1231 erie download and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get b1231 erie county?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the b1231 erie form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit b 1231 form straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 1995 ny b1231.

What is NY B-1231 - Erie County?

NY B-1231 - Erie County is a specific form used for tax purposes within Erie County, New York, designed to facilitate the reporting of certain financial data related to property transfers.

Who is required to file NY B-1231 - Erie County?

Individuals or entities involved in real property transactions in Erie County, including buyers, sellers, and title companies, are required to file the NY B-1231 form.

How to fill out NY B-1231 - Erie County?

To fill out NY B-1231, you must provide accurate details about the property, including the buyer's and seller's information, the property's description, purchase price, and applicable exemptions. Follow the instructions provided on the form carefully.

What is the purpose of NY B-1231 - Erie County?

The purpose of NY B-1231 - Erie County is to ensure proper recording of property transactions for tax assessment and compliance with local regulations.

What information must be reported on NY B-1231 - Erie County?

On NY B-1231, individuals must report information including the property address, the buyer's and seller's names and addresses, the sale price, date of transfer, and relevant exemptions or special assessments.

Fill out your NY B-1231 - Erie County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

b1231 Erie is not the form you're looking for?Search for another form here.

Keywords relevant to b1231 erie create

Related to b1231 erie document

If you believe that this page should be taken down, please follow our DMCA take down process

here

.